The Education Trust’s Comment on the Department of Education’s Proposed Improvements to Income-Driven Repayment

February 10, 2023

Richard Blasen

Office of Postsecondary Education

U.S. Department of Education 400 Maryland Ave., SW Washington, DC 20202

RE: Improving Income-Driven Repayment for the William D. Ford Federal Direct Loan Program (Docket ID ED–2023–OPE–0004)

On behalf of The Education Trust, an organization committed to advancing policies and practices to dismantle the racial and economic barriers embedded in the American education system, thank you for the opportunity to comment on the U.S. Department of Education’s (“the Department”) request for comment on the proposal to amend the regulations governing income-contingent repayment plans by amending the Revised Pay as You Earn (REPAYE) repayment plan, and to restructure and rename the repayment plan regulations under the William D. Ford Federal Direct Loan (Direct Loan) Program, including combining the Income-Contingent Repayment (ICR) and the Income-Based Repayment (IBR) plans under the umbrella term of “Income-Driven Repayment (IDR) plans.”

We are encouraged that the Department is taking steps to improve income-driven repayment plans. Approximately 43 million Americans collectively owe $1.6 trillion in federal student loan debt, but this burden is not borne equally by all. Black students are more likely to take on debt, borrow higher amounts, and struggle with repayment than their peers, because they generally have fewer resources to pay for college, thanks to the ongoing generational effects of systemic racism. This debt burden has far- reaching financial consequences, and many Black borrowers are unable to afford their monthly payments. Federal income-driven repayment (IDR) plans, which are meant to make monthly payments manageable, often do anything but and can be ineffective at reducing a borrower’s debt burden over time. Borrowers who participated in the National Black Student Debt Study — a survey of nearly 1,300 Black borrowers and in-depth interviews with 100 borrowers conducted by Jalil B. Mustaffa, Ph.D., co- founder of the Equity Research Cooperative, and researchers from The Education Trust — said that income-driven repayment plans feel like a lifetime debt sentence. That is why the Department should strengthen the proposed changes to the Revised Pay As You Earn (REPAYE) repayment plan.

We applaud these proposed changes to Income-Driven Repayment Plans:

- Expanding access to affordable monthly payments on Direct Loans through changes to the REPAYE repayment plan.

- Lowering the share of discretionary income that the REPAYE formula would mandate be put toward monthly payments so that borrowers with only outstanding loans for an undergraduate program pay 5% of their discretionary income.

- Stopping the monthly accrual of any remaining unpaid interest after a borrower’s payment has been applied (under the modified REPAYE plan).

- Allowing borrowers to receive credit toward forgiveness for certain periods of deferment or forbearance. And create a new provision that would allow borrowers who don’t automatically qualify for credit to make additional payments and get credit for those months. The proposed regulations would also allow borrowers to maintain credit toward forgiveness for payments made prior to loan consolidation.

- Streamlining and standardizing the Direct Loan Program repayment regulations by locating all repayment plan provisions in sections of the regulations that are listed by repayment plan type: fixed payment, income driven, and alternative repayment plans.

- Simplifying the provision that ensures that a borrower who fails to recertify their income is placed in an alternative repayment plan.

- Clarifying the repayment plan options available to borrowers through streamlining of the regulations and reducing complexity in the student loan repayment system by phasing out enrollment in the existing IDR plans to the extent that current law allows, except that no borrower would be required to switch to a different repayment plan.

- Eliminating burdensome and confusing recertification regulations for borrowers using IDR plans.

However, while we appreciate the proposed changes outlined above, the magnitude of the student debt crisis means that additional reforms to the proposed new REPAYE plan are needed to make student debt repayment more affordable for Black borrowers, who have the heaviest debt burdens, fewer financial resources with which to repay their debt because of the racial wage and wealth gaps, take longer to pay off student debt, and are more likely to use forbearance or default on their loans. The Education Trust recommends the following improvements and additions:

- Raise the share of income that is exempted from payment calculations to 300% of the applicable federal poverty guideline, instead of the proposed 225%.

- Lower the share of discretionary income that must go toward monthly payments and make borrowers with outstanding graduate school loans pay only 5% of their discretionary income monthly, which is on par with monthly undergraduate loan payment requirements.

- Reduce the repayment period to 10 years and cut the time to cancellation for all borrowers, regardless of original principal loan balance; also shorten the time to cancellation for Public Service Loan Forgiveness to eight years.

- Cancel a portion of the outstanding balance at regular intervals — e.g., after every 12 months of payments — and clear any remaining outstanding balance after 10 years or 120 monthly payments.

- Make Parent PLUS borrowers eligible for the proposed new REPAYE plan without needing to consolidate.

- We support the expanded categories for deferment and forbearance proposed in the NPRM, but borrowers should also be allowed to request a lower payment in times of economic hardship (e.g., due to major medical expenses or debt, the need to pay for child care, elder care, or other dependent care).

We hope the Department will consider the subsequent information when determining the final regulations governing the REPAYE plan and other income-driven repayment plans.

Black Borrowers Have the Heaviest Student Debt Burden

College costs have risen dramatically over the past several decades in large part because state funding for public colleges and universities declined dramatically.1 In the 1975-76 academic year, the average yearly full cost of a public four-year college — which includes tuition, fees, and room and board, was $1,780, or $8,444 in 2020-21 dollars, compared to $21,377 in the 2020-21 academic year.2 Financial aid has failed to keep pace with these rising costs, resulting in a higher education system that is unaffordable for most Americans. In 1980, the Pell Grant, the nation’s most important need-base grant, covered over 75% of the full cost of a public four-year college; in the 2020-21 academic year, it covered only 28%.3

Because of systemic racism, the inequitable distribution of wealth, a stratified labor market, and rising college costs, Black borrowers are among those most negatively affected by student loans.4 Black people borrow the most and struggle the most with repayment. One year after completing their bachelor’s degree, Black borrowers owe $39,043, on average, in principal and interest, compared to $28,661 for White borrowers.5 Black borrowers owe $55,532 in graduate loans, compared to $27,962 for White borrowers.6 And Black borrowers who are in repayment owe more than their White counterparts.

Twelve years after starting college, the typical Black borrower owes 13% more than they originally borrowed and has paid down none of their balance, while the typical White borrower has successfully paid down 35% of their original loan balance.7

The Racial Wage and Wealth Gaps Are Fanning the Black Student Debt Crisis

The racial wage and wealth gaps make student loan repayment especially challenging for Black borrowers. To reduce the amount owed on a loan, a borrower must pay enough to cover interest and a portion of the principal every month. But that is difficult for a Black borrower to do when they don’t make much or have many resources to begin with. In 2020, Black workers aged 25 to 64 who held a bachelor’s degree or higher and worked full time and year-round had median earnings of $65,135, compared to $77,162 for White workers with only a bachelor’s degree.8 In fact, Black workers need a professional degree to outearn White workers with a bachelor’s degree.9 But that’s only part of the story. The racial wealth gap — which reflects the accumulated negative effects of centuries of systemic racism, including but not limited to slavery, Jim Crow laws, redlining, lending discrimination, and labor market and wage discrimination — makes things worse.10 In 2019, the median Black household had just

$24,100 in wealth next to $188,200 for the median White household.11 What’s more, obtaining a higher education does not erase that gap. In fact, the median Black household headed by a person with a bachelor’s degree has less wealth than the median White household headed by a person without a high school diploma.12 According to a 2021 report by Andre Perry, Ph.D., a senior fellow at Brookings Metro and a scholar-in-residence at American University, 52% of Black households with student loans have zero or negative wealth, versus just 25% of Black households without student debt.13

For Black Borrowers, Income-Driven Repayment Plans Are Often a Lifetime Debt Sentence

Many Black borrowers who participated in the study said they feel like student loans are a lifetime debt sentence and income-driven repayment plans that saddle borrowers with more debt are a part of the problem.14

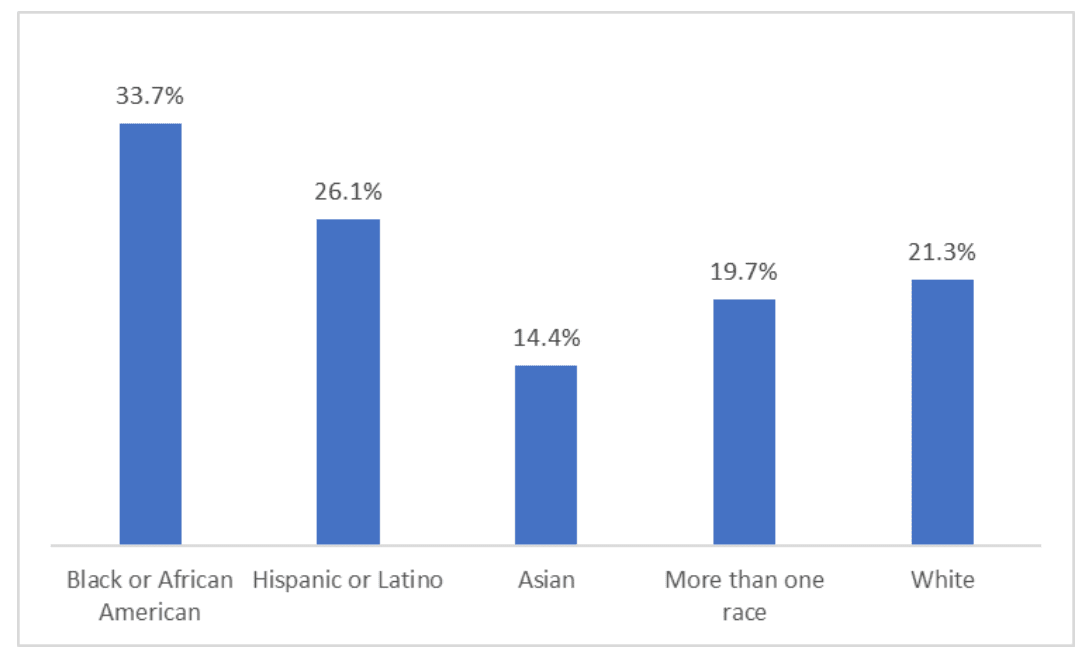

Racial pay and wealth inequities leave many Black borrowers with no option but to turn to IDR plans. According to federal data, 45.4% of Black borrowers say they are very likely to use IDR plans, and 23.4% say they are somewhat likely to use them, compared to 25.7% and 22% of White borrowers respectively. Twelve months after completing a bachelor’s degree, 33.7% of Black borrowers were enrolled in an IDR plan, a higher percentage than any other racial or ethnic group with usable data (see Figure 1).

Figure 1: Percentage of borrowers in IDR plans (by race/ethnicity), 12 months after completing a bachelor’s degree

Source: U.S. Department of Education, National Center for Education Statistics, Baccalaureate and Beyond: 2016/2017 (B&B)

Note: American Indian or Alaska Native and Native Hawaiian/other Pacific Islander were not included because reporting standards were not met.

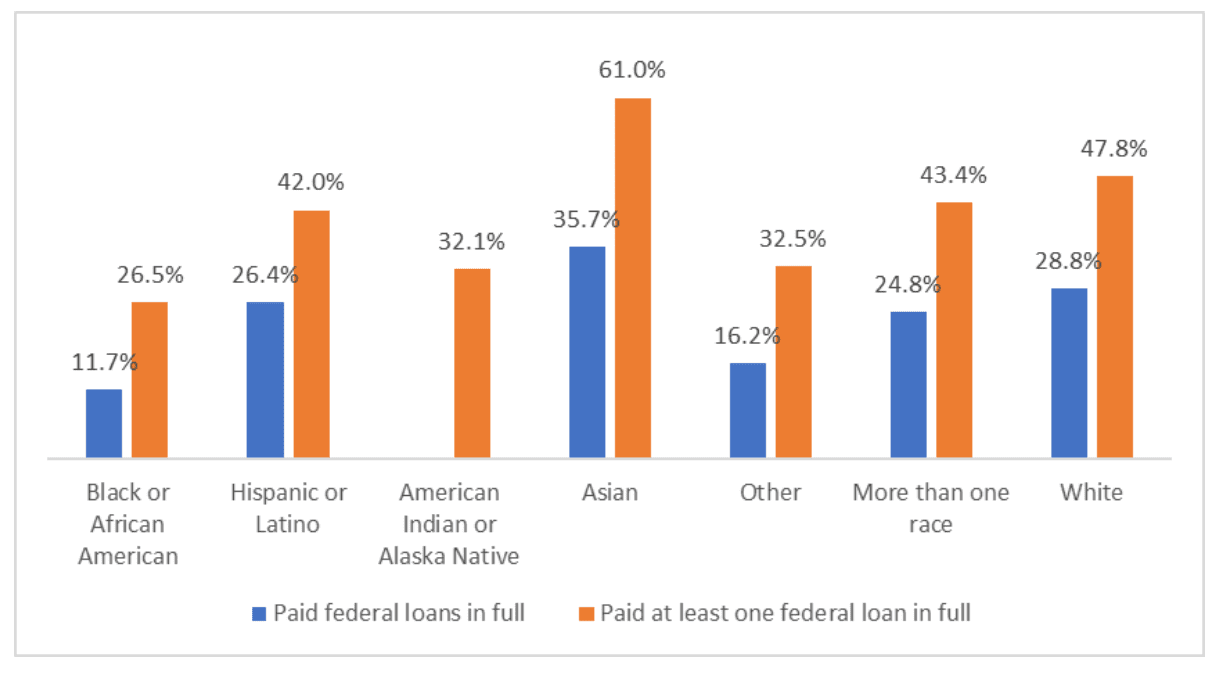

Many Black borrowers are still paying their student loans and will be for the foreseeable future. Of the Black borrowers who began their postsecondary education in 2004, only 11.7% had fully repaid their federal student debt 12 years later — i.e., by June 30, 2015 (see Figure 2).15 Just 3.3% had fully repaid their loans without defaulting or having a portion of their loan discharged.16 During this same time frame, only 26.5% of Black borrowers managed to pay off at least one federal loan in full — less than any other racial or ethnic group (see Figure 2).17 Bill, who borrowed $130,000, says he’s made little headway, despite many years of making payments: “When I came out of school, I owed $120,000. I’ve been paying for 15 years, and I owe $110,000.”18

Figure 2: Percentage of borrowers (by race/ethnicity) who started college in 2004 and had repaid all federal student loan debt or at least one federal student loan (or any federal student loan) within 12 years

Source: U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

Note: “Paid federal loans in full” for American Indian or Alaska Native borrowers is not included because reporting standards were not met.

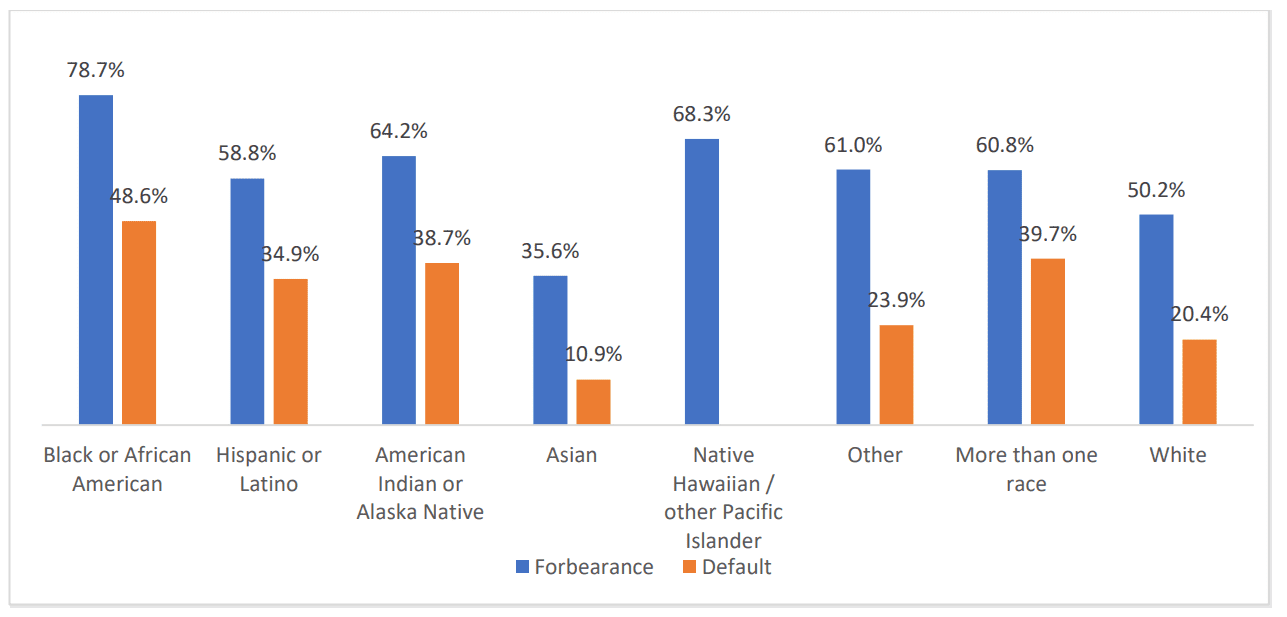

Existing Income-Driven Repayment Plans Don’t Prevent Many Black Borrowers From Defaulting or Using Forbearance

Bill’s situation is not an anomaly. Despite the existence of IDR plans, which are intended to help keep borrowers out of delinquency and default, Black borrowers still have the highest forbearance and default rates of any group. Nearly 49% of Black borrowers defaulted on their loans within 12 years of starting college, much higher than any other group (see Figure 3). 19 Default occurs when a borrower misses nine months of payments on a federal student loan. It can ruin a person’s credit and make it harder for them to rent an apartment, buy a car or a home, or even get a job. In addition, if a borrower defaults on a federal student loan, the government may garnish their wages and Social Security income or withhold tax refunds and other public benefits.20 In April 2022, the Department of Education announced that it would give borrowers who were delinquent or in default a “fresh start” that would allow them to resume repayment in good standing.21 This initiative will help over 7.5 million borrowers in default.22

More than 78% of Black borrowers have used forbearance,23 which is an option that lets struggling borrowers temporarily pause or lower monthly payments. However, using forbearance increases the amount owed on a loan, as interest continues to accrue. At the end of the forbearance, that accrued interest is capitalized, meaning it is added to the principal; and going forward, interest will accrue on this new, higher principal balance.24 Using forbearance is costly — borrowers will pay more interest over the life of the loan — and not a good long-term solution. Additionally, time spent in forbearance does not count toward federal student loan forgiveness.

Figure 3: Percentage of borrowers (by race/ethnicity) who began college in 2004 and defaulted or used forbearance within 12 years

Source: U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

Note: Default for Native Hawaiian/other Pacific Islander not included because reporting standards were not met

How Loan Servicers Undermined Income-Driven Repayment Plans

A key feature of many IDR plans is the promise that after 20 or 25 years of making qualifying payments a borrower’s remaining loan balance will be cancelled. In theory, this is supposed to ensure that borrowers aren’t making payments indefinitely. In practice, though, many borrowers who’ve made payments for 20 – 25 years or more are no closer to debt cancellation. Data from the U.S. Department of Education shows that of the 2 million borrowers who were eligible for IDR loan cancellation in 2019, only 32 of them have had their outstanding debt cleared. 25

Loan servicers — that is, the companies that manage student loans on behalf of the federal government— are at least partly to blame.26 They are responsible for placing borrowers into payment plans;

managing billing, forbearances, and deferments; collecting and tracking borrowers’ payments and balances; and submitting reports to credit bureaus; and, therefore, play a critical role in the student loan repayment process. For IDR plans to work properly, loan servicers must not only guide struggling borrowers to the right plan, but also effectively track their payments and maintain accurate records.

Unfortunately, some servicers have failed on all counts.

Not surprisingly, the industry has a long history of misleading and harming borrowers financially.27 Reporting by NPR has revealed the extent to which several loan servicers undermined IDR plans and financially harmed millions of borrowers.28 Documents from the Department of Education show that these loan servicers steered borrowers into forbearance instead of income-driven repayment plans, even though the lowest-income borrowers could have had monthly payments as low as $0 or $5.

Forbearance steering is particularly harmful to borrowers with low incomes because the time spent in forbearance doesn’t count toward cancellation, and loan interest continues to accumulate. What’s more, three loan servicers neglected to track borrowers’ payments and progress toward cancellation at all.29

We thank the Department for taking action to improve income-driven repayment plans, and we ask that the Department consider incorporating our recommendations into the final revised REPAYE plan.

We are happy to respond to any questions that you may have regarding the contents of this letter; please contact Reid Setzer, Director of Government Affairs. Thank you for your consideration.

Sincerely,

The Education Trust

1 Victoria Jackson and Matt Saenz, States Can Choose Better Path for Higher Education Funding in COVID-19 Recession (Center on Budget and Policy Priorities, February 17, 2021), https://www.cbpp.org/research/ state-budget-and-tax/states-can-choose- better-pathfor-higher-education-funding-in-covid

2 U.S. Department of Education, National Center for Education Statistics, Table 330.10. Average undergraduate tuition, fees, room, and board rates charged for full-time students in degree-granting postsecondary institutions, by level and control of institution: Selected years, 1963-64 through 2020-21, https://nces.ed.gov/programs/digest/d21/tables/dt21_330.10.asp

3 “Why It’s Time to Double Pell” (The Institute for College Access and Success and UNCF, 2020), https://ticas.org/wp- content/uploads/2020/11/Why-Its-Time-to-Double-Pell.pdf.

4 William Darity Jr., Darrick Hamilton, Mark Paul, Alan Aja, Anne Price, Antonio Moore, and Caterina Chiopris, What We Get Wrong About Closing the Racial Wealth Gap (Samuel DuBois Cook Center on Social Equity and Insight Center for Community Economic Development, April 2018), https://socialequity.duke.edu/portfolio-item/what-we-get-wrong-about-closing-the-racial- wealth-gap/.

5 U.S. Department of Education, National Center for Education Statistics, Baccalaureate and Beyond: 2016/2017 (B&B).

6 U.S. Department of Education, National Center for Education Statistics, National Postsecondary Student Aid Study: 2016 Graduate Students (NPSAS:GR) and Baccalaureate and Beyond: 2016/2017 (B&B).

7 U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

8 U.S. Census Bureau, Current Population Survey, 2021 Annual Social and Economic Supplement (CPS ASEC), https://www.census.gov/data/tables/time-series/demo/income-poverty/cps-pinc/pinc-03.2020.html#par_textimage_54.

9 U.S. Census Bureau, Current Population Survey, 2021 Annual Social and Economic Supplement (CPS ASEC).

10 Darity et al., What We Get Wrong About Closing the Racial Wealth Gap.

11 Neil Bhutta, Andrew C. Chang, Lisa J. Dettling, and Joanne W. Hsu, “Disparities in Wealth by Race and Ethnicity in the 2019 Survey of Consumer Finances,” FEDS Notes (Washington, DC: Board of Governors of the Federal Reserve System, September 28, 2020), https://doi.org/10.17016/2380-7172.2797.

12 Darrick Hamilton, William Darity Jr., Anne E. Price, Vishnu Sridharan, Rebecca Tippett, Umbrellas Don’t Make It Rain: Why Studying and Working Hard Isn’t Enough for Black Americans (The New School, April 2015), https://www.insightcced.org/wp- content/uploads/2015/08/Umbrellas_Dont_Make_It_Rain_Final.pdf.

13 Andre M. Perry, “Student Debt Cancellation Should Consider Wealth, Not Income” (Brookings Institution, February 25, 2021),

https://www.brookings.edu/essay/student-debt-cancellation-should-consider-wealth-not-income/.

14 Jalil Bishop and Jonathan Davis, Jim Crow Debt: How Black Borrowers Experience Student Loans (The Education Trust, October 20, 2021), https://edtrust.org/resource/jim-crow-debt/.

15 U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

16 U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

17 U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

18 Quote from borrower in National Black Student Debt study. Pseudonym used.

19 U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

20 Federal Student Aid, “Student Loan Delinquency and Default | Federal Student Aid,” https://studentaid.gov/manage- loans/default.

21 U.S. Department of Education, “Biden-Harris Administration Extends Student Loan Pause Through August 31,” April 6, 2022, https://www.ed.gov/news/press-releases/biden-harris-administration-extends-student-loan-pause-through-august-31

22 Zack Friedman, “Student Loan Relief: How To Qualify For A ‘Fresh Start’ On Your Student Loans,” Forbes, April 13, 2022, https://www.forbes.com/sites/zackfriedman/2022/04/13/how-to-qualify-for-a-fresh-start-on-your-student- loans/?sh=5c408fe349c7.

23 U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

24 Federal Student Aid, “Income-Driven Plans Questions and Answers,” https://studentaid.gov/manage- loans/repayment/plans/income-driven/questions.

25 “Education Department’s Decades-Old Debt Trap: How the Mismanagement of Income-Driven Repayment Locked Millions in Debt” (National Consumer Law Center, March 2021), https://www.nclc.org/images/pdf/student_loans/IB_IDR.pdf.

26 Federal Student Aid, “Who’s My Student Loan Servicer?,” https://studentaid.gov/manage-loans/repayment/servicers.

27 “Student Loan Servicing” (Consumer Financial Protection Bureau, September 2015), https://www.consumerfinance.gov/data- research/research-reports/student-loan-servicing/.

28 Cory Turner, “Exclusive: How the Most Affordable Student Loan Program Failed Low-Income Borrowers,” NPR, April 1, 2022, sec. Investigations, https://www.npr.org/2022/04/01/1089750113/student-loan-debt-investigation.

29 Cory Turner, “Exclusive: How the Most Affordable Student Loan Program Failed Low-Income Borrowers,” NPR, April 1, 2022, sec. Investigations, https://www.npr.org/2022/04/01/1089750113/student-loan-debt-investigation.