Dear Speaker Ryan, Leader Pelosi, Majority Leader McCarthy, Minority Whip Hoyer, Chairwoman Foxx and Ranking Member Scott,

The Higher Education Act (HEA) originated in the spirit of expanding opportunity so that no student would be denied a chance to participate in higher education due to finances or social status. Today, higher education serves as the most effective engine of social mobility.1 As Congress begins the work of reauthorizing HEA, the 35 undersigned organizations, representing students, schools, faculty and staff, consumers, veterans, civil rights, and higher education advocates, urge you to work together to prioritize college affordability and access to higher education for low-income students and families.

The rising cost of college limits upward mobility in our society, with college becoming increasingly inaccessible and unaffordable for low-income students. Even after accounting for grant funding from all sources, low-income students still have to find a way to finance, on average, the equivalent of more than 100 percent of their family income to cover their net college costs at a four-year institution — leading them to take on disproportionate levels of debt.2 In an economy where postsecondary credentials are critical for securing a good job, these financial barriers significantly limit social mobility and the development and expansion of a skilled workforce.3

The federal government is not fulfilling its end of the bargain in helping students access and afford higher education. Pell Grants are the foundation of our national investment in higher education and go to students with significant financial need. Yet the maximum Pell Grant for 2017-18 covers less than 30 percent of the cost of attendance at a public, four-year institution — the lowest share in over 40 years.4 Pell Grant students are already more than twice as likely to have student loans. Nine in 10 Pell Grant recipients who graduate from four-year colleges graduate with debt, and they have an average debt of nearly $5,000 more than their higher income peers.5 Robust investment in the Pell Grant is needed to reverse its declining purchasing power and reduce the disproportionate burden of debt among students with the highest financial need.

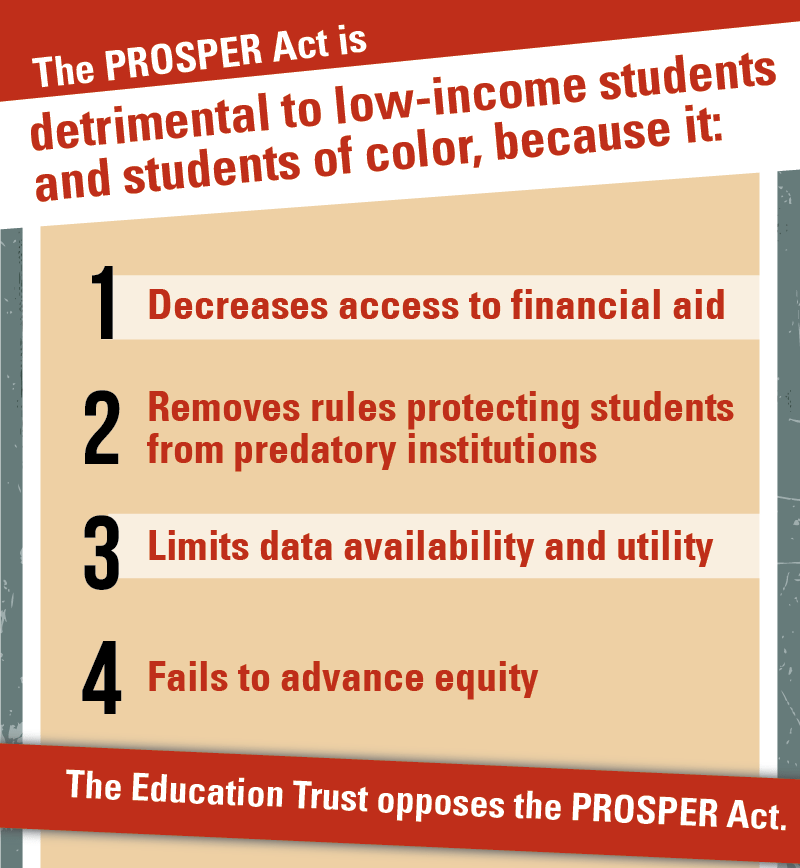

Instead of working to rectify these issues, the PROSPER Act, which passed out of the Education and the Workforce Committee along party lines, exacerbates the increasing burden of student debt and continued inequity in higher education access and outcomes. It would make higher education less affordable, saddle students with greater debt, and push more students into loan default.

Significant changes to the PROSPER Act are needed to adequately prioritize students, increase affordability, and close equity gaps in higher education. We urge you to delay moving the bill forward until such changes are made.

Sincerely,

| American Association of University Women (AAUW) |

American Federation of State, County, and Municipal Employees (AFSCME) |

Association of Catholic Colleges and Universities |

| Center for Law and Social Policy (CLASP) |

Contra Costa Community College District |

Council for Opportunity in Education |

| Demos |

Foothill-De Anza Community College District |

Generation Progress |

| Higher Ed, Not Debt |

Higher Education Loan Coalition |

John Burton Advocates for Youth |

| Maryland Consumer Rights Coalition |

NAACP |

National Association for College Admission Counseling |

| National Consumer Law Center (on behalf of its low-income clients) |

National Education Association |

National Youth Employment Coalition |

| PHENOM (Public Higher Education Network of Massachusetts) |

SEIU |

Shasta College |

| Student Action |

Student Debt Crisis |

Student Senate for California Community Colleges |

| Student Veterans of America |

The Education Trust |

The Institute for College Access & Success (TICAS) |

| U.S. PIRG (Public Interest Research Groups) |

uAspire |

UnidosUS formerly NCLR |

| University of California Student Association |

Veterans Education Success |

Women Employed |

| Yes We Must Coalition |

Young Invincibles |

|

CC:

Members of the U.S. House of Representatives

Chairman Lamar Alexander

Ranking Member Patty Murray

1) Jennifer Ma, Matea Pender, and Meredith Welch, Education Pays 2016: The Benefits of Higher Education for Individuals and Society, College Board, https://trends.collegeboard.org/sites/default/files/education-pays-2016-full-report.pdf

2) IHEP calculation NPSAS:12 using PowerStats

3) Anthony P. Carnevale, Tamara Jayasundera, and Artem Gulish, Good Jobs Are Back: College Graduates Are First in Line, Georgetown University, 2015, https://cew.georgetown.edu/cew-reports/goodjobsareback/

4)TICAS, “Pell Grants Keep College Affordable for Millions of Americans,” June 2017, https://ticas.org/sites/default/files/pub_files/overall_pell_one-pager.pdf

5)Calculations by TICAS on data from the U.S. Department of Education, National Postsecondary Student Aid Study, 2011-12

February 05, 2018 by

February 05, 2018 by