On behalf of The Education Trust, an organization committed to advancing policies and practices to dismantle the racial and economic barriers embedded in the American education system, thank you for the opportunity to comment on the U.S. Department of Education’s (“the Department”) request for comment in support of the Department’s intent to establish a negotiated rulemaking committee to prepare proposed regulations for the Federal Student Aid programs authorized under Title IV of the Higher Education Act of 1965.

In June 2023, the U.S. Supreme Court struck down the Biden administration’s plan to cancel up to $10,000 in federal student loans for borrowers who make less than $125,000, or less than $250,000 for married couples and heads of household, and up $20,000 for Pell Grant recipients who meet the income requirements — denying financial relief for approximately 40 million Americans. We support the Biden administration’s intention to use the legal authority granted by the Higher Education Act of 1965, which gives the U.S. Secretary of Education the power to “enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand, however acquired, including any equity or any right of redemption.”1Legal experts at the Legal Services Center of Harvard Law School have determined that broad student debt cancellation is a “lawful and permissible exercise of the Secretary’s authority under existing law.”2We support exercising this authority to ensure that borrowers who have been previously authorized for relief are included in the new plan and would urge the Department to focus on broad student debt cancellation as it moves forward.

We applaud the Biden administration for continuing to fight to cancel student debt for approximately 40 million Americans. This October, millions of borrowers will have to start repaying their federal student loans, after a necessary payment pause of more than three years due to the COVID-19 pandemic. Over those three years, borrowers have experienced high unemployment and record-high inflation, and a recession may still be looming. Many of these borrowers — particularly Black borrowers, who are more likely to borrow, borrow more, and struggle most with repayment — will struggle to repay their loans once payments resume3and will be harmed by the Supreme Court’s decision.4Black borrowers have the worst student debt outcomes of any racial or ethnic group because they generally have fewer resources to pay for college, thanks to the ongoing generational effects of systemic racism.5The Student Borrower Protection Center estimates that 3.8 million of the 8.5 million Black borrowers could have their entire loan balance cancelled under the administration’s debt cancellation plan.6And, 14 million Pell Grant recipients could see their entire balance cancelled.7

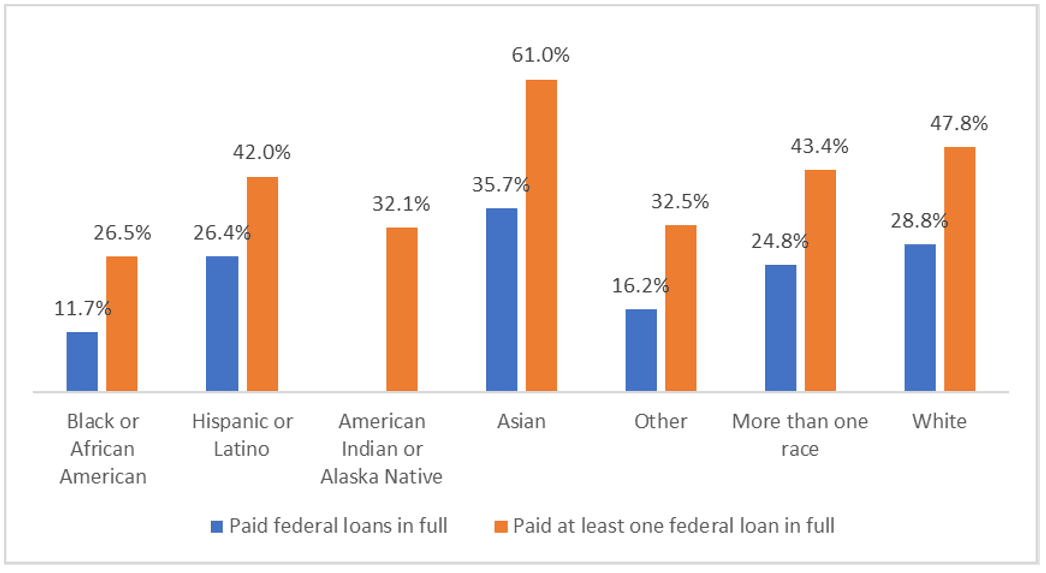

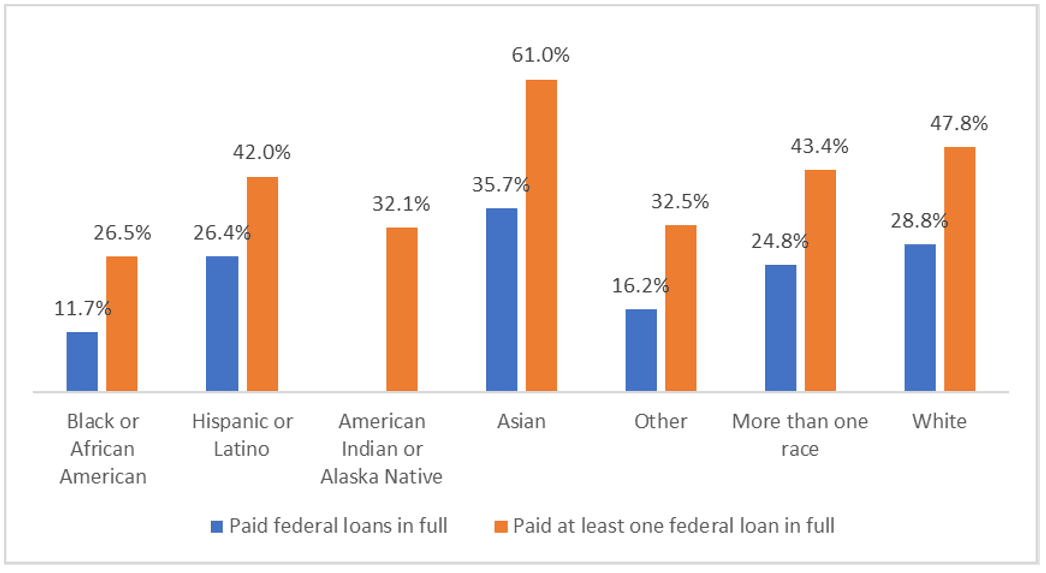

We appreciate the Biden administration’s acknowledgement, through policy, that student debt cancellation is critical economic relief for Americans with federal student loans. Many borrowers, especially Black borrowers, spend years, if not decades, repaying their loans. Of the Black borrowers who began their postsecondary education in 2004, only 11.7% had fully repaid their federal student debt 12 years later — i.e., by June 30, 2015.8Just 3.3% had fully repaid their loans without defaulting or having a portion of their loan discharged.9During this same period, only 26.5% of Black borrowers managed to pay at least one federal loan in full — less than any other racial or ethnic group.10What’s more, over that 12-year period, less than 36% of borrowers from any racial or ethnic group managed to repay their federal student loans in full (see Figure 1).

Figure 1: Percentage of borrowers (by race/ethnicity) who started college in 2004 and had repaid all federal student loan debt or at least one federal student loan (or any federal student loan) within 12 years

Source: U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

Note: “Paid federal loans in full” for American Indian or Alaska Native borrowers is not included because reporting standards were not met.

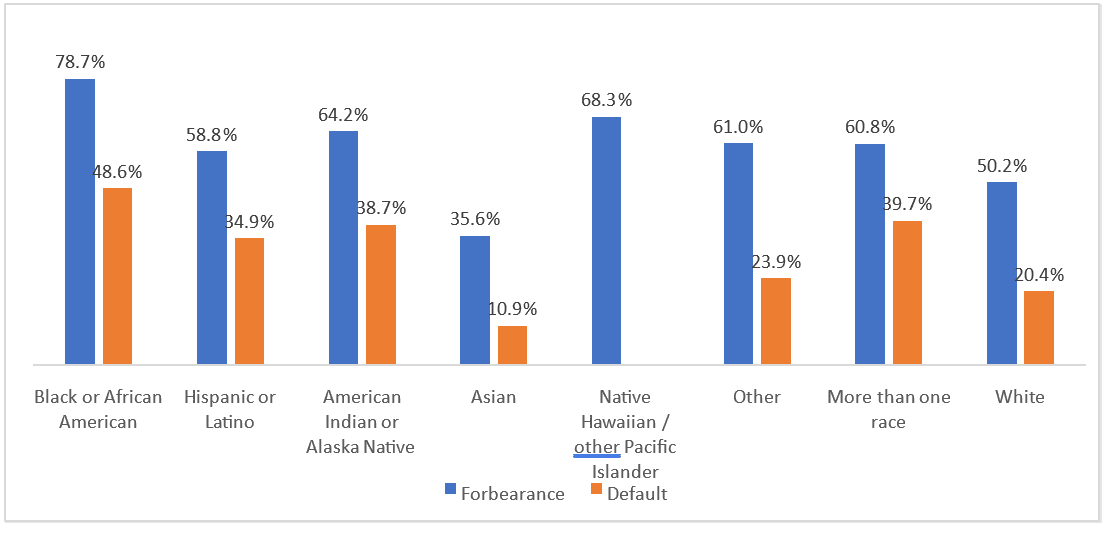

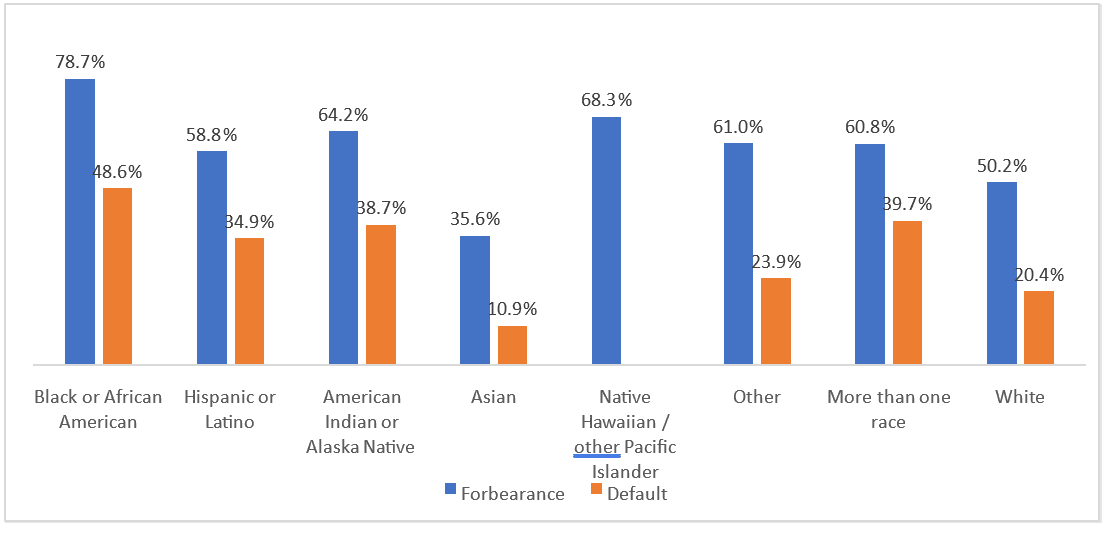

Many borrowers struggle to make payments and end up relying on forbearance or even defaulting on their loans. These situations are common for Black borrowers, who have the highest forbearance and default rates of any group. Nearly 49% of Black borrowers defaulted on their loans within 12 years of starting college (see Figure 2).11Default occurs when a borrower misses nine months of payments on a federal student loan. It can ruin a person’s credit and make it harder for them to rent an apartment, buy a car or a home, or even get a job. In addition, if a borrower defaults on a federal student loan, the government may garnish their wages and Social Security income or withhold tax refunds and other public benefits.12

More than 78% of Black borrowers have used forbearance,13which allows struggling borrowers to temporarily pause or lower monthly payments. However, using forbearance increases the amount owed on a loan, as interest continues to accrue. At the end of the forbearance, that accrued interest is capitalized — meaning it is added to the principal — and going forward, interest will accrue on this new, higher principal balance.14Using forbearance is costly — borrowers will pay more interest over the life of the loan — and not a good long-term solution. Additionally, time spent in forbearance does not count toward federal student loan forgiveness.

Figure 2: Percentage of borrowers (by race/ethnicity) who began college in 2004 and defaulted or used forbearance within 12 years

Source: U.S. Department of Education, National Center for Education Statistics, Beginning Postsecondary Students: 2004/2009 (BPS).

Note: “Default” for Native Hawaiian/other Pacific Islander not included because reporting standards were not met.

We applaud the administration for giving borrowers a 12-month “on-ramp” to repayment, which will protect them from the negative consequences of late, missed, or partial payments when payments resume in October 2023. During that time, payments will still be due, and interest will accrue, but unpaid interest will not capitalize until after the 12-month period has expired. Borrowers who use the on-ramp period will not be reported to credit bureaus, considered in default, or sent to collections. The on-ramp to repayment and broad student debt cancellation would provide borrowers with a meaningful reprieve from the punitive consequences of delinquency and broad student debt cancellation would provide struggling borrowers with necessary relief.

We thank the Biden administration for continuing to fight for student debt cancellation. We are happy to respond to any questions that you may have regarding the contents of this letter; please contact Reid Setzer, Director of Government Affairs. Thank you for your consideration.

Sincerely,

The Education Trust

August 28, 2025 by

August 28, 2025 by