How Affordable Are Public Colleges in Your State?

For millions of college-going students, one of the most urgent concerns is the rising cost of college and how to pay for it — and not just for tuition but other necessities like textbooks, housing, food, and transportation. The idea that one can work one’s way through college with a minimum-wage job is, in most cases, a myth.

Students from low-income backgrounds should be able to attend college without shouldering a debt burden or having to work so many hours that they jeopardize their chances of completing a degree.

In this report we look closely at just how much beyond their means students from low-income backgrounds are being asked to pay for a college degree at both public four-year institutions and community and technical colleges in each state.

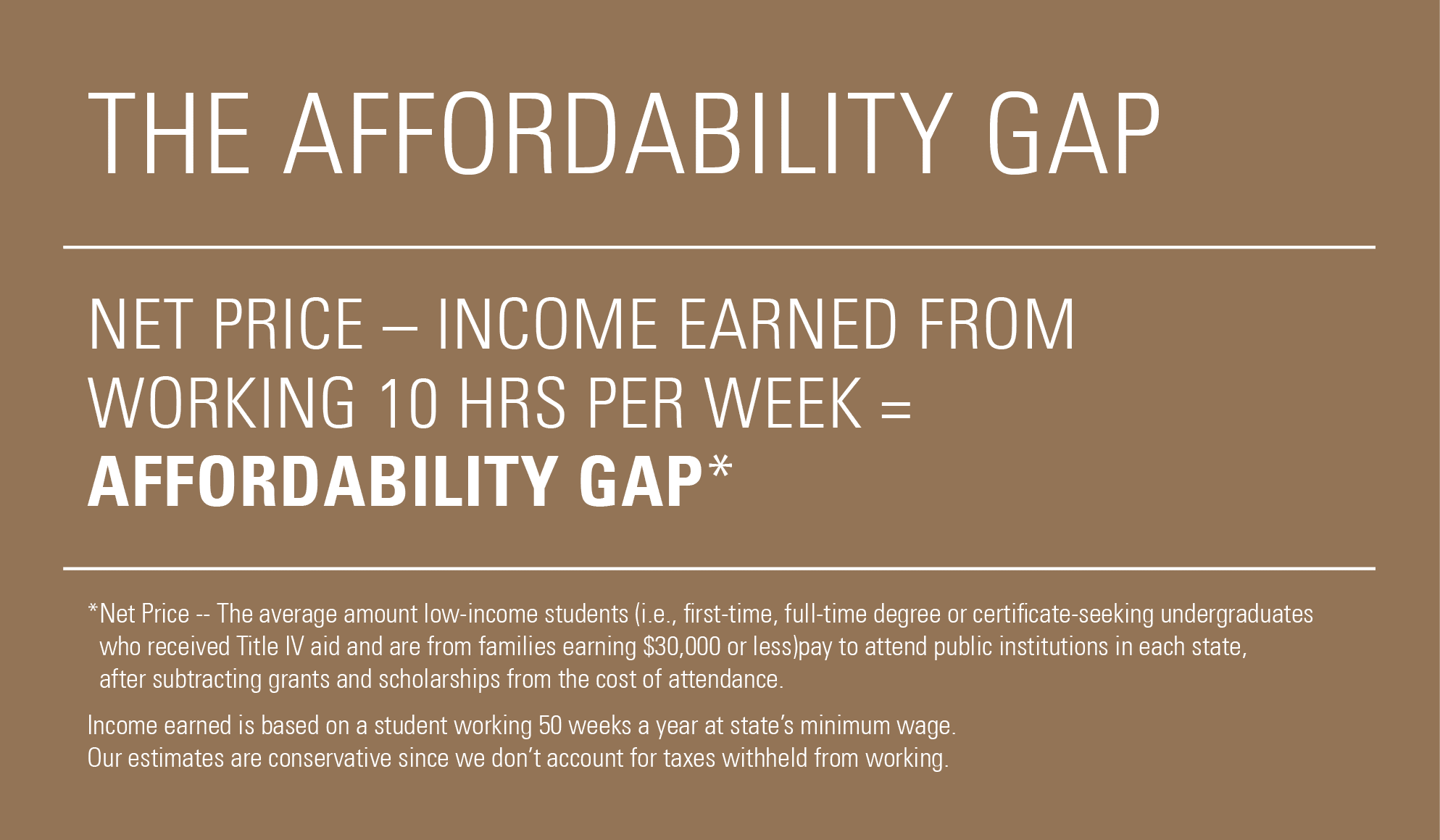

What is the Affordability Gap?

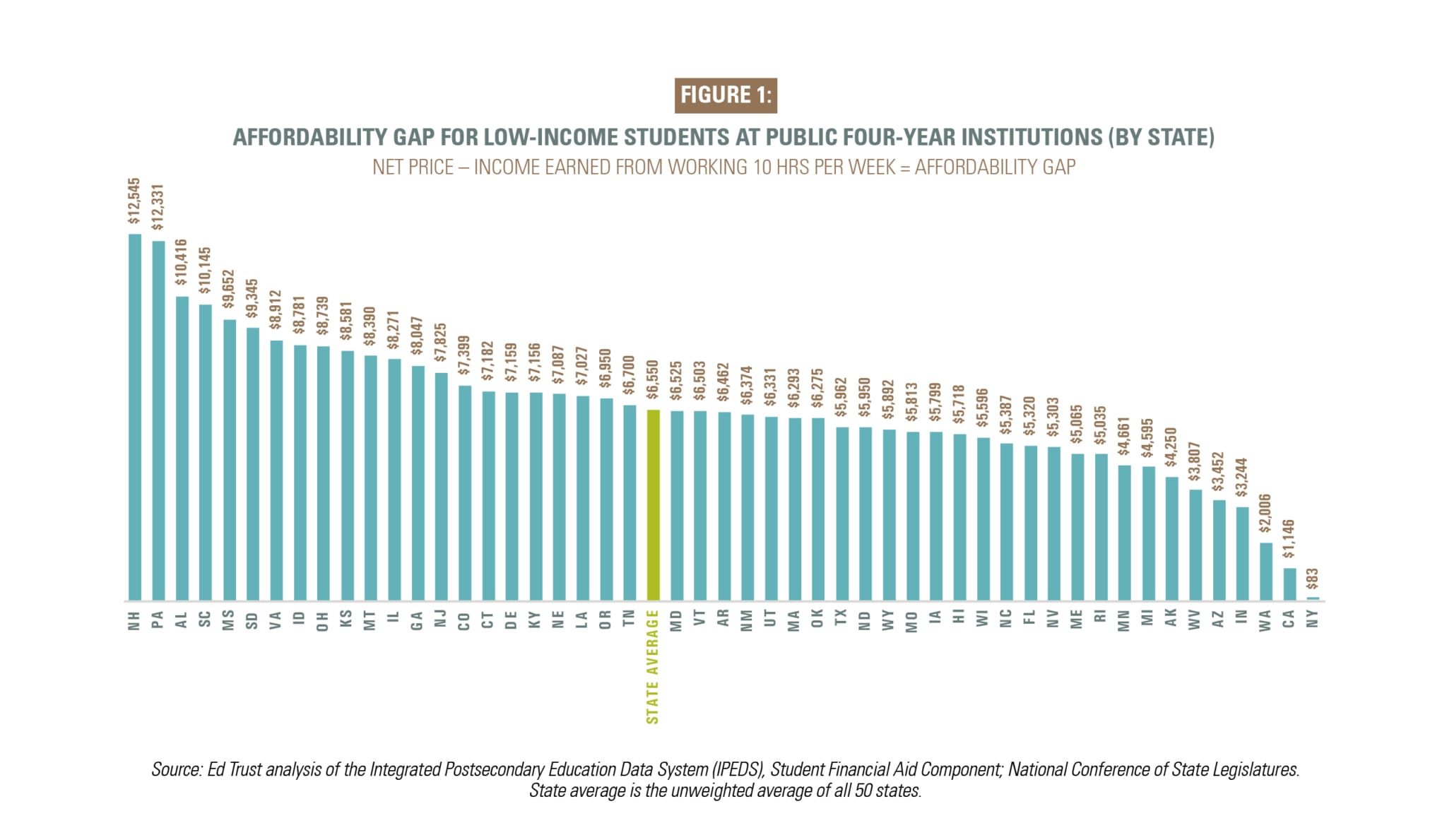

After grants, scholarships, and earnings from working 10 hours per week (a reasonable workload that won’t jeopardize academic success), students from low-income backgrounds still have to come up with thousands of dollars to cover the full cost at public colleges in just about every state. We call this the “affordability gap.”

High-Level Findings

- The affordability gap facing first-year students from low-income backgrounds at public four-year colleges exceeds $3,000 in nearly every state, and the state average is slightly more than $6,500.

- In 47 of 50 states, low-income students need to work more than 15 hours per week to pay the net price at a public four-year college.

- In New Hampshire and Pennsylvania students from low-income backgrounds would have to work over 40 hours per week at minimum wage to pay for public four-year college.

- On a positive note, there are few states such as Washington, California, and New York that, for traditional students from low-income backgrounds, are close to our recommended maximum of 10 hours of work per week.

How does your state stack up?

Find out with our State Equity Report Card

Affordability at Public Community and Technical Colleges

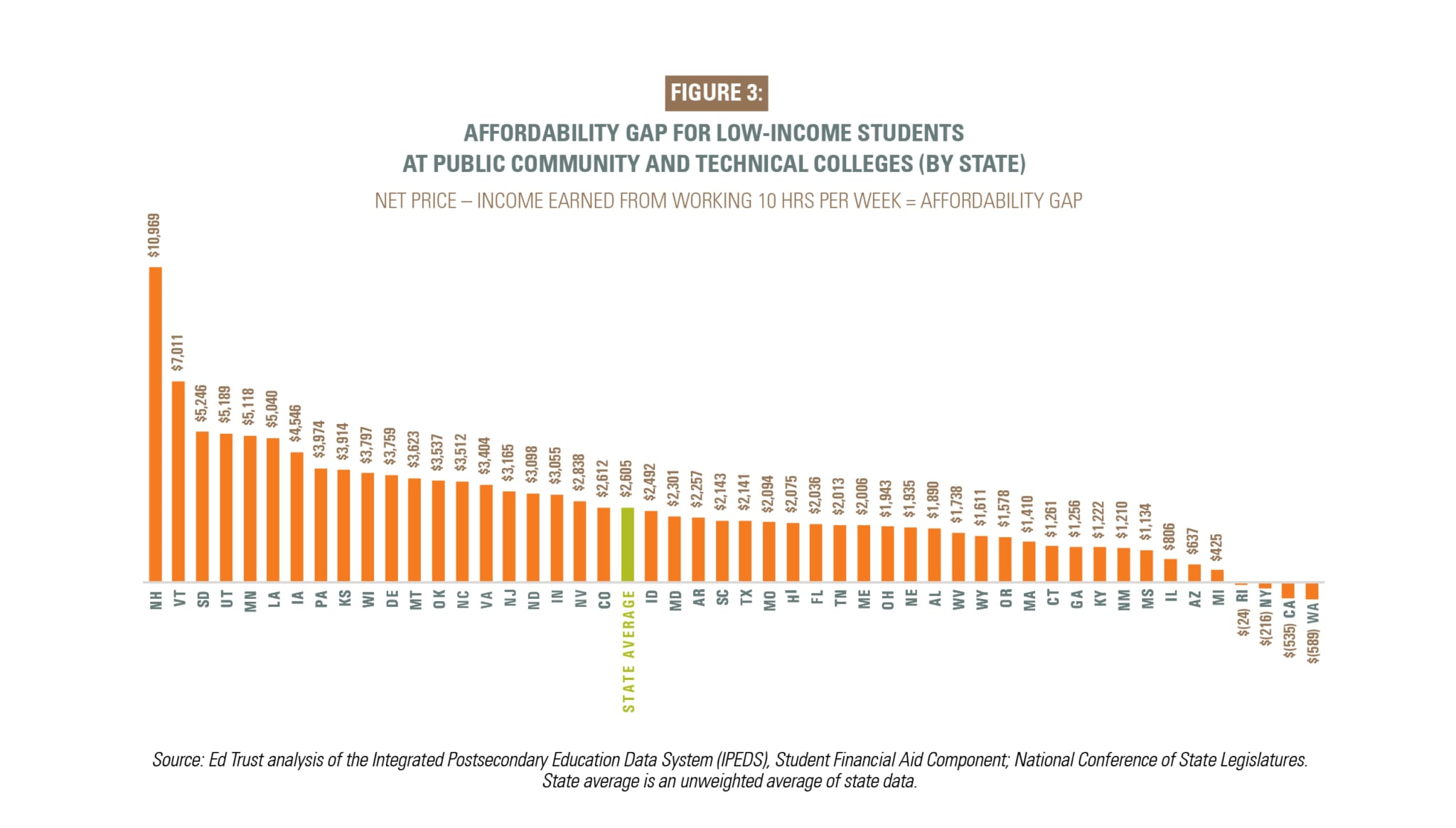

While it remains true that public community and technical colleges are often the most affordable options for students from low-income backgrounds who hope to earn a degree or certificate, in most states, there is a college affordability gap even at these schools.

The affordability gap exceeds $2,500 in 20 states at public community and technical colleges with the costliest state approaching $11,000. Our report also found that students – on average – would have to work slightly more than 16 hours a week to pay for public community and technical colleges in the state average.

“The full cost of college should be debt-free for students from low-income backgrounds and affordable for all. In states like Pennsylvania and New Hampshire, students from low-income backgrounds have to work more than 40 hours a week on top of a full-time course load at a public four-year college to avoid student debt.”

– Wil Del Pilar, vice president of higher education at Ed Trust

While states like California appear to be very affordable at the community college level, this is only for traditional students from low-income backgrounds –students enrolling for the first time, full time who received Federal financial aid. The majority of community college students attend part-time, are coming back to school after some time away, and many are raising families of their own. And they face higher hurdles on the path to paying for college.

Ed Trust recommends policymakers take the following steps to make college more affordable for students from low-income backgrounds:

- Invest in need-based aid at the state and federal level

- Ensure that approaches to free college programs cover the full cost of attendance for students from low-income families

- Reinvest in higher education at the state-level